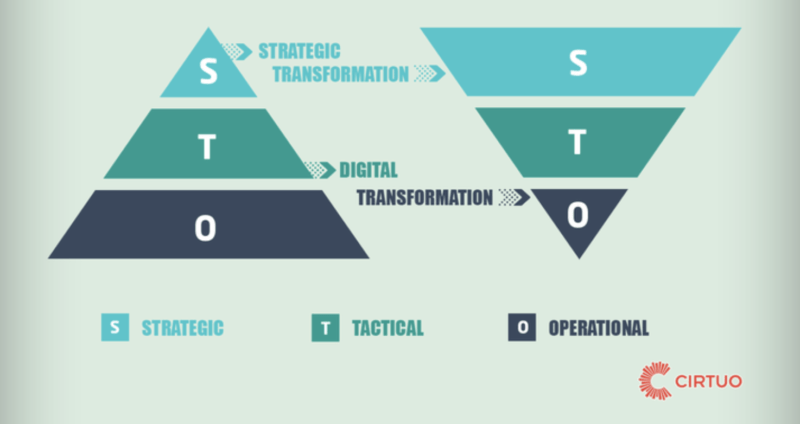

I’m a great proponent of advanced digitalization within the procurement function. Paired with strategic planning and adequate hiring practices, it’s a combination that is a real game changer for any company. But the current climate of implementation also leaves me with a lingering question: Did all of the progress we’ve made manage to do some damage along the way? What that means for me is that even though buyers have access to tactical digital tools, oftentimes those are used without a clear, strategic direction which then leads to lackluster results.

The way I have always seen it, sourcing is a well-crafted tactical part of strategic, integrated Category Management. I’ve written about it about a month ago, you can read it here. Only when there’s a substantial strategic prelude before sourcing activities can they truly bring in results worthy making a remark about. But, let’s start from the beginning. In my opinion, sourcing can be divided into three types, according to frequency and impact, which can be found in mutual combinations:

Sourcing C

Type C is ad hoc sourcing that mainly deals with momentary demand. It can be project/investment oriented, it can handle regular inquiries or one-offs. The purpose of this type is to achieve competitive pricing for a specific demand. It is highly routinized and it is not able to bring in a strategic change of paradigm necessary for next level savings on its own.

Sourcing B

Type B is framework agreement sourcing, i.e. annual negotiations with suppliers for bundled or local quantities. The purpose is to maintain purchasing prices competitive and possibly include new suppliers, but it is usually aimed at preferred or known suppliers. This type rarely offers a change of paradigm, it is a same old dance that most buyers do at the end of the year.

Sourcing A

This type refers to category review or big tender sourcing. Its purpose is to significantly reduce the purchasing price and review the supplier base by involving a broad range of new potential suppliers. My personal nickname for this type is The Show Program, because it takes the procurement function out of its rut and creates a big showcase of new suppliers, new savings and new directions. It is done for group-wide bundled quantities and quantity projections (e.g. new projects, life cycle spend, etc.).

My experience has shown that often buyers are under the impression that they have included the entire spend, but under closer examination it turns out that is not the case. Either they simply can’t see the spend in its entirety because of ERP limitations or sometimes the decision is deliberate. The entire sourcing effort is a lengthy process dependent on previously chosen strategy and the level of internal support, but my personal recommendation is that category review sourcing is implemented every 2-4 years because this type does offer a change of paradigm.

The show program is expected to introduce new elements in sourcing in order to increase credible threat to current suppliers and to motivate new suppliers. It is a mobilizing force that has an effect on suppliers, overall spend and on internal clients, given that it is preferable that a steering committee is formed for seamless strategy implementation. It’s a wake-up call for change, it shakes up the market, the company makes sure it doesn’t pay above market value and significant savings emerge. After such a healthy shake-up, it’s safe to return to type B and C.

Who doesn’t like a show?

Unfortunately, category review sourcing is frequently forgotten, yet it is vital for this day in age. The efficiency of type B and C has been significantly increased with digitalization, but type A is still something that is not done in-house, it is left for consultants. Sure, it is a daunting task and it is understandable that people are hesitant to change, but often that reluctance can bring greater problems in the future. It basically depends on the group character of a procurement team, whether they mostly focus on obstacles or on opportunities. In my career, I have heard so many obstacle-minded expressions and I have decided to share some of the typical statements prior to sourcing activities:

- “We send inquiries only to preferred / approved suppliers”

- “This supplier can not meet our requirements”

- “Shifting quantities to a new supplier is a high supply risk”

- “We have no time to develop supplier-neutral specification”

- “Clarification of technical issues is a significant effort – the supplier does not speak any English”

- “This supplier was too expensive last time – we do not need to send him the RFP”

- “We do not want to include suppliers from Low-Cost Countries – they can not meet our requirements”

- “We can not send the RFP to supplier A – we had a bad experience with him”

- “We shouldn’t go ahead with this sourcing process with our current suppliers – to preserve good business relationships”

Now, some of these statements are potentially legitimate and some of them can prove to be true. But all of these require a quality analysis and then they can easily be resolved. And yet, none of them are reasons to dismiss a process that can open up new opportunities. By always being on one’s toes and observing the market like a hawk, gives a reassurance that no matter what happens, you have a solution. And, it’s really nice to see a show every once in a while.

Sourcing is a very important topic and there is so much to cover, so I have decided to split it up into parts so I can give as much as concrete information as possible. The next part will deal with how to segment any sourcing process, how should an RFI be prepared and implemented and why it is crucial for multi-level mobilization.

If you want to keep up with industry insights, be sure to follow Cirtuo’s LinkedIn page